News

Outcrop Silver Intersects 2.71 Metres True Width of 615 Grams Silver Equivalent per Tonne Expanding Las Maras High-Grade at Depth

Outcrop Silver & Gold Corporation (TSXV:OCG, OTCQX:OCGSF, DE:MRG1) (“Outcrop”) is pleased to announce the results of two additional core holes designed to test the continuity at depth of the Las Maras shoot on its 100% owned Santa Ana high-grade silver project in Colombia. Twenty-five holes have been drilled up to date at Las Maras, fifteen returned high-grade assays, and two holes have pending assays.

Las Maras shoot has an average true width of 1.6 metres with a weighted average grade of 1,139 grams equivalent silver per tonne for all significant drill holes.

Highlights

-

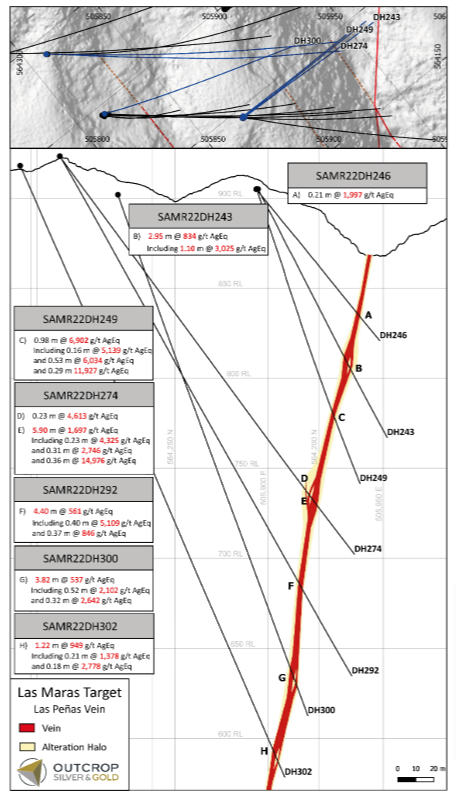

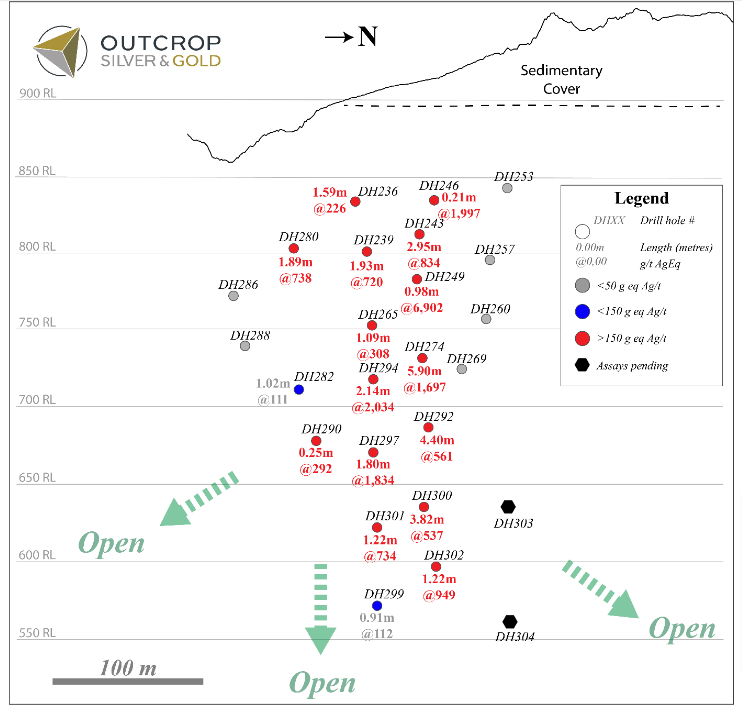

New drill results extend Las Maras high-grade mineralization to the north below 350 metres depth (Figure 3).

-

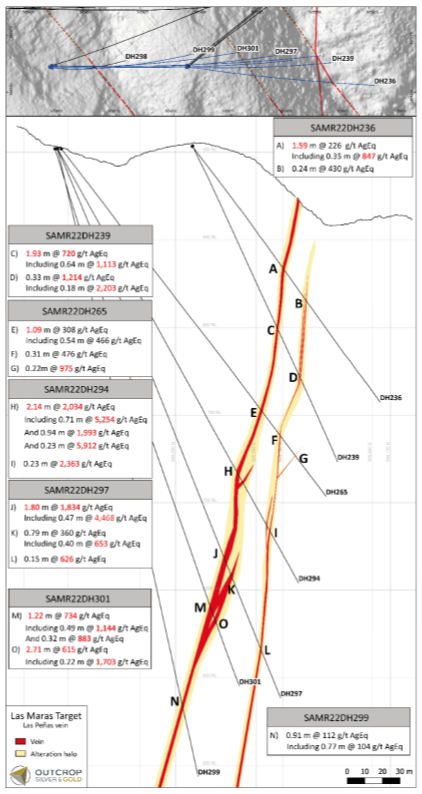

DH301 returned 2.71 metres true thickness of 615 grams equivalent silver per tonne, including 0.57 metres of 1,523 grams equivalent silver per tonne.

-

DH302 returned 1.22 metres true thickness of 949 grams equivalent silver per tonne.

-

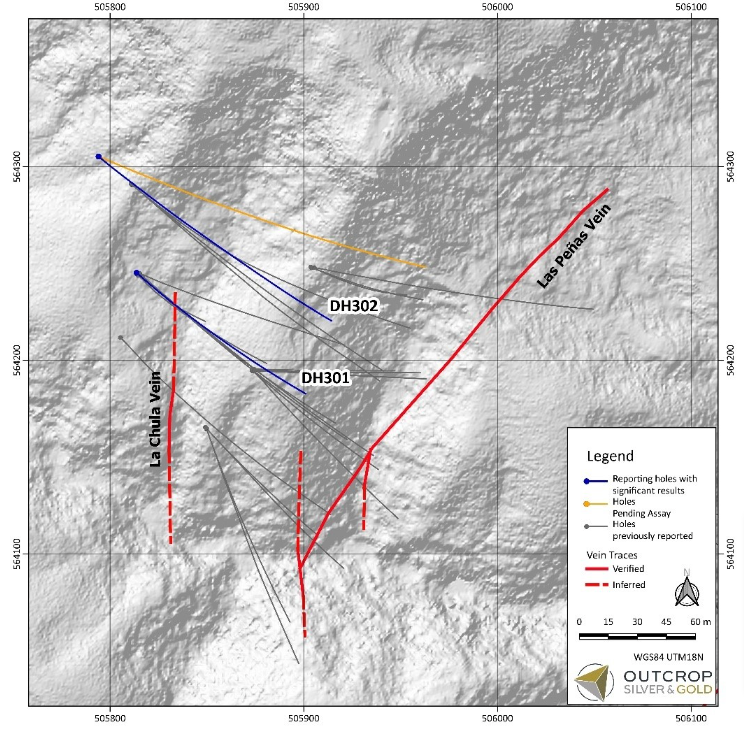

Drilling shows that Las Maras shoot includes a package of subparallel veins and mineralized splays off the main veins (Figure 1).

-

Mineralization in Las Peñas vein of the Las Maras shoot remains open at depth (Figure 3).

“We continue to expand our Las Maras shoot with good results that encourage us to keep delineating this fantastic target,” commented Guillermo Hernandez, Vice President of Exploration. “Our delineation program continues adding deeper high-grade intercepts within the Santa Ana vein system showing great potential upside at depth.”

“Detailed studies show that two of three prevalent mineralization events at Santa Ana are mesothermal,” comments Joseph Hebert, Chief Executive Officer. “Mesothermal vein systems are known for their large size and continuation to substantial depths. As controls to mineralization are resolved, Santa Ana is likely to be significantly expanded at depth.”

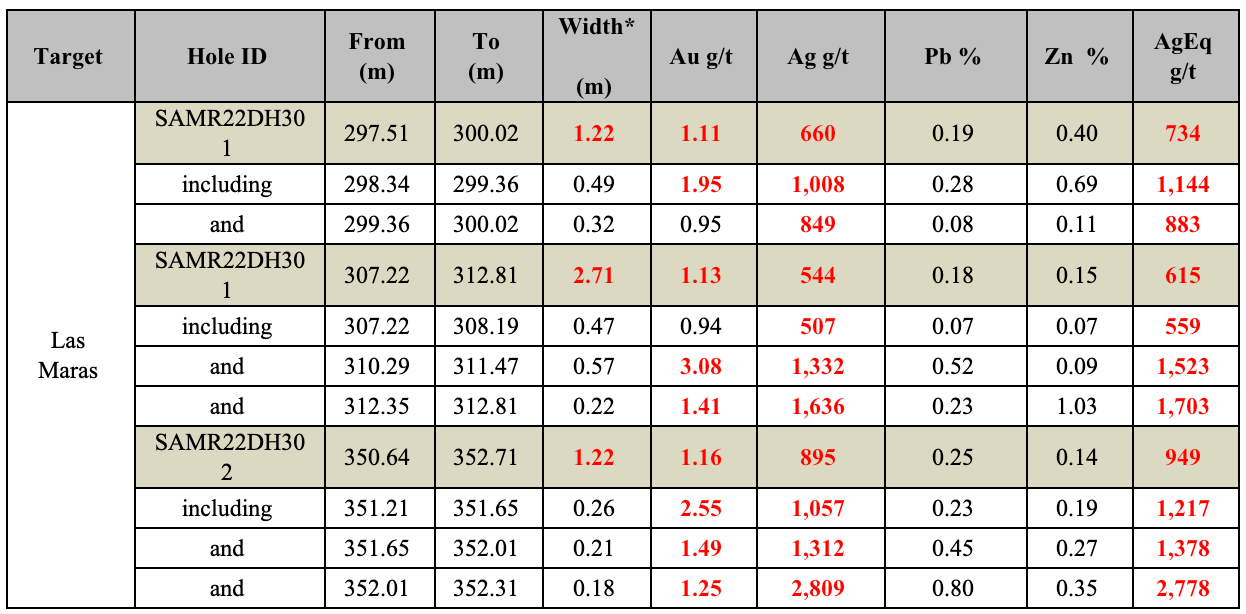

*Estimated True width. Metal prices used for equivalent calculations were US$1,827/oz for gold, US$21.24/oz for silver, US$0.90/lb for lead and US$1.56/lb for zinc. Metallurgical recoveries assumed are 93% for gold, 90% for silver, 90% for lead and 92% for zinc.

Table 1. Significant drill assays from Las Maras.

Twenty-five drill holes have been completed up to date, and fifteen returned high-grade assays and two holes with assays that are pending (Figure 3). The current drilling program at Las Maras continues with additional delineation holes targeting step-down intercepts at depth from hole DH290 (see news release dated October 27, 2022).

Drilling shows Las Maras has an average true thickness of almost 1.6 metres and a weighted average grade of 1,139 grams equivalent silver per tonne. Conventional long-hole stopes can be designed at 1.5 metres, in some cases down to 1-metre stopes. In a future mining scenario for Las Maras with a 1.6-metre vein width and 1.5-metre minimum stope width, external mining dilution would be well constrained.

Map 1. Las Maras with drill hole traces.

Figure 1. Cross section of Las Maras from this release.

Figure 2. Cross section of Las Maras from this release.

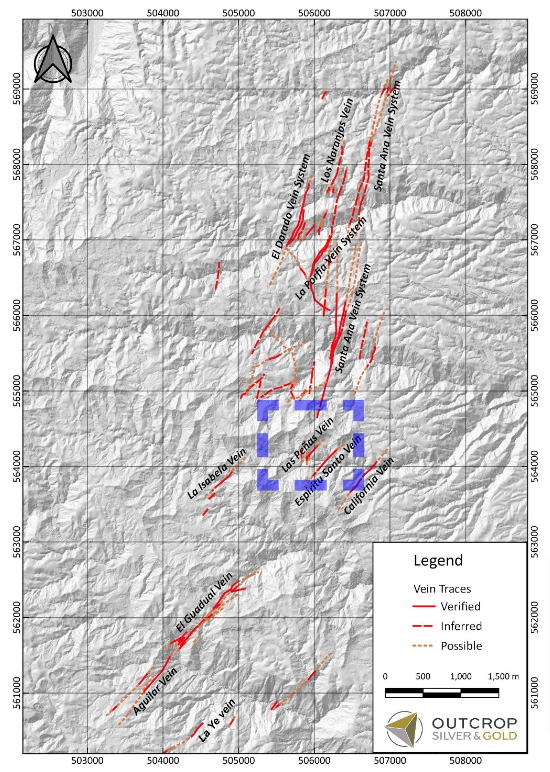

Map 2. Location of Las Peñas vein at Las Maras shoot, 3 km south of the main Santa Ana vein system.

Figure 3. The schematic longitudinal section from Las Maras shoot with drill pierce points shows the estimated true width. Metal prices used for equivalent calculations were US$1,827/oz for gold, US$21.24/oz for silver, US$0.90/lb for lead and US$1.56/lb for zinc. Metallurgical recoveries assumed are 93% for gold, 90% for silver, 90% for lead and 92% for zinc.

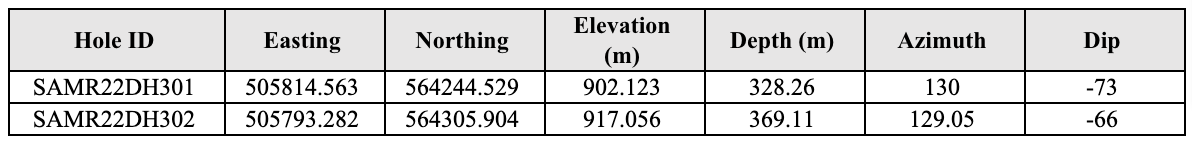

Table 2. Collar and survey table for drill holes reported in this release

QA/QC

Core samples are sent to either Actlabs or SGS in Medellin, Colombia, for preparation and AA assaying on Au and Ag, then to SGS Lima, Peru, for multi-element analysis. Samples sent to Actlabs are then shipped to Actlabs Mexico for multi-element analysis. In line with QA/QC best practice, approximately three control samples are inserted per twenty samples (one blank, one standard and one field duplicate). The samples are analyzed for gold using a standard fire assay on a 30-gram sample with a gravimetric finish when surpassing over limits. Multi-element geochemistry is determined by ICP-MS using aqua regia digestion. Comparison to control samples and their standard deviations indicate acceptable accuracy of the assays and no detectible contamination.

About Santa Ana

The 100% owned Santa Ana project comprises 36,000 hectares located in the northern Tolima Department, Colombia, 190 kilometres from Bogota. The project consists of five or more regional scale parallel vein systems across a trend 12 kilometres wide and 30 kilometres long. The Santa Ana project covers a majority of the Mariquita District, where mining records date to at least 1585. The Mariquita District is the highest-grade primary silver district in Colombia, with historic silver grades reported to be among the highest in Latin America from dozens of mines. Historic mining depths support a geologic and exploration model for composite mesothermal and epithermal vein systems having mineralization that likely extends to great depth. At Santa Ana, it is unlikely that there is sharp elevation restriction common to high-grade zones in many epithermal systems with no mesozonal component. The extremely high silver and gold values on Santa Ana reflect at least three recognized overprinting mineralization events.

At the core Royal Santa Ana project, located at the northern extent of just one of the regional vein systems controlled by Outcrop, thirteen high-grade shoots have been discovered to date – La Ivana hanging-wall and footwall (La Porfia vein system); San Antonio, Roberto Tovar, San Juan (Royal Santa Ana vein systems); Las Maras (Las Penas vein system); El Dorado, La Abeja (El Dorado vein systems); Megapozo, Paraiso (El Paraiso vein system); Espiritu Santo (Aguilar vein system); La Isabela and Los Naranjos. Each zone commonly contains multiple parallel veins. The veins can show both high-grade silver and high-grade gold mineralization, and low-angle veins appear to connect to more common high-angle veins.

Outcrop drilling indicates that mineralization extends from surface or near surface to depths of at least 370 metres. Cumulatively, over 60 kilometres of mapped and inferred vein zones occur on the Santa Ana project. The Frias Mine on the south-central part of the project, 16 kilometres south of the Royal Santa Ana Mines, produced 7.8 million ounces of silver post-production in the Spanish colonial era at a recovered grade of 1.3 kg Ag/t. The Frias Mine is considered an analogue to each of the thirteen shoots discovered to date by Outcrop. Between the Royal Santa Ana Mines and the Frias Mine, veins have been extended to the south providing strong drill targets in the Aguilar, Espiritu Santo and El Cristo veins that show high values up to 5.5 kg AgEq/t. These veins show widths up to 4.7 metres. Twelve kilometres of vein zones have been mapped between El Dorado vein to the north and the Aguilar vein to the south. An additional seven kilometres of veins have been mapped between Aguiler and the Frias mine, including the veins Los Mangos and La Ye, which provide several targets with high values up to 9,738 g AgEq/t.

About Outcrop Silver & Gold

Outcrop Silver & Gold is rapidly advancing the Santa Ana high-grade silver discovery with ongoing expansion drilling and an initial resource to be released in the coming months. Outcrop is also progressing exploration on four gold projects with world-class discovery potential in Colombia. These assets are being advanced by a highly disciplined and seasoned professional team with decades of experience in Colombia.

Qualified Person

The technical information in this news release has been approved by Joseph P Hebert, a qualified person as defined in NI43-101 and President and Chief Executive Officer of Outcrop.

ON BEHALF OF THE BOARD OF DIRECTORS

|

Joseph P Hebert |

Kathy Li |

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “potential”, “we believe”, or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.